Houston TX 77389 Shortsale

Shortsale Details

| Anticipated Foreclosure Date | Dec 3, 2011 |

| First Mortgage with Chase Bank, NA | $1,002,379.81 |

| Property Taxes | $27,276.00 |

| Total Owed | $1,029,655.81 |

| Market Value | $925,000.00 |

| Accepted by Debt Holders | $796,552.98 |

| Savings | $233,102.83 |

| Time to Negotiate Shortsale | 4 days |

Property Location

Property Details

| Address | Houston, TX 77389 |

| County | Harris |

Listing a short sale is a little like venturing into the wild, wild west. There’s only a little order, lots of imposters, and laws are broken without much penalty.

Real estate agents bring a little stability to the transaction, but a short sale’s success depends on a variety of variables. This type of transaction is constantly evolving; however there are a few things that remain the same, and that every agent needs to know when working with short sales.

Market Value Matters

Short sales sell for market value. That’s right. A bank will typically agree to a short sale if the numbers make sense. Banks understand that homes need to appraise. Banks also need to mitigate their loss.

Listing a home for well below market value is not the best strategy for getting a short sale accepted. Sure, you may get plenty of offers, but if the bank won’t accept any of them you end up having wasted a ton of energy, not to mention paper, and facing quite a few angry potential buyers.

Banks are no longer in the business of giving away houses. If you send the bank numbers that make sense, you increase your likelihood of a successful short sale closing by 90%.

Only Real Hardships Get the Help

I’ve lost count of the number of times potential sellers have told me the only reason they are pursuing a short sale is because everyone else is doing it. Purchasing a house during the housing boom is not a legitimate hardship. Purchasing a house during the housing boom and being unable to pay your mortgage is a hardship.

Strategic default is never a good idea! Banks actually analyze short sale sellers’ hardships, and most center on the economy, so the bank is going to make sure that a short sale is in their own best interest. Acceptable hardships include medical issues, divorce, disability, significant loss of income, death, unemployment, and relocation.

HCAD

HCAD NoticeOfTrustee Sale 7/5/2011

NoticeOfTrustee Sale 7/5/2011 IRS_982

IRS_982 IRS_4681_Cancellation of Debt

IRS_4681_Cancellation of Debt Chase Payoff $1,002,379.81

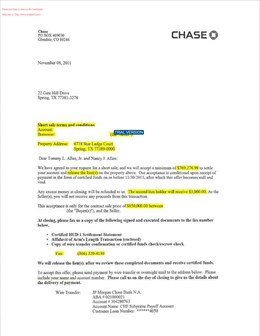

Chase Payoff $1,002,379.81 Chase Approval letter $769,276

Chase Approval letter $769,276 Final HUD

Final HUD done

done done

done